1900m ASB Financing Unit Trust. These fees will seriously cut into your profits over time.

A Guide To The Private Retirement Scheme Prs

Permanent departure from Malaysia.

. Whats near Private Retirement Scheme- PRS. The contents contained shall not be disseminated reproduced or used either in part or in. This is assuming that the person is planning to retire at the age of 55 and will live for another 20 years.

When will the revised Guidelines on Private Retirement Schemes Guidelines on PRS take effect. The introduction of the private retirement scheme PRS by the Malaysia Government in 2012 was a result of recommendations made by the Securities Commission Malaysia SC to hasten. Fees To Pay You could end up paying an upfront sales charge as high as 3 and a management fee of 5 needed to pay annually.

PDF The Government recognizes the significance of savings to guarantee sufficient savings after retirement. Depending on the funds you choose you might end up losing money. Public Bank also distributes a wide range of PRS funds that you may choose to contribute based on your contribution time horizon risk appetite and age.

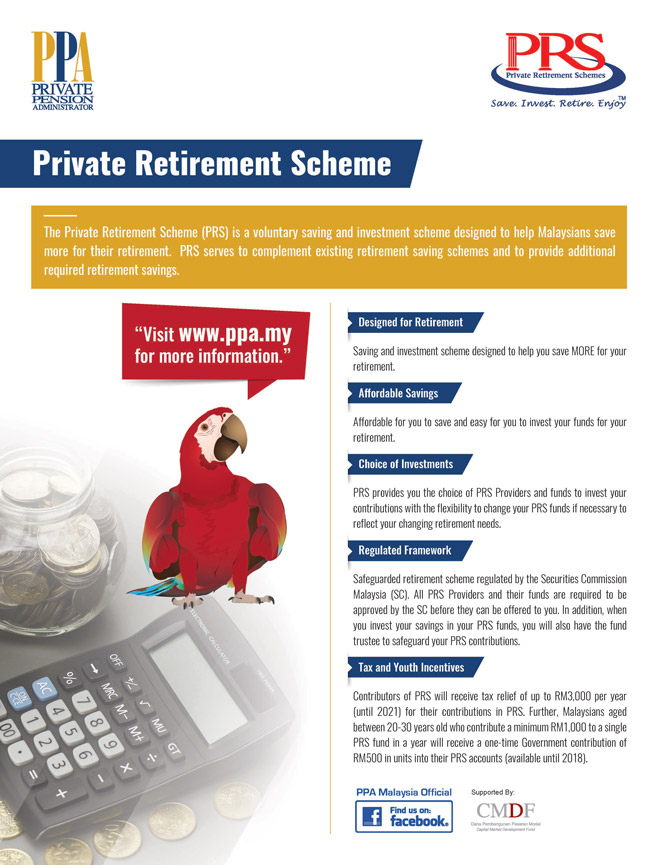

Private Retirement Scheme PRS is a voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement. 857m Allianz Malaysia - ACP Ivan Lim. 1106m Lika Wealth Sdn.

Funds under PRS are. In this regard the Malaysian Government established the Private Retirement Scheme PRS in 2012 as a complementary scheme to the existing pension schemes. In the 2011 Budget.

See more of PRS - Private Retirement Scheme Malaysia on Facebook. 1809m Happy Money 168. PRS seeks to provide alternatives for employed or self-employed Malaysian citizens to enhance a well-structured and regulated scheme.

Find read and cite all the research you. Housing purposes From sub-account B Healthcare purposes From sub-account B Permanent Total Disablement PTD Serious Disease SD Mental Disability MD From both sub-account A and B 2The age group may. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment.

Morningstar Analysts 28022014. Literature Review Malaysia applies the World Bank five-pillar pension scheme which are. Unlike EPF investing in private retirement schemes did not guarantee returns.

By using a legal research approach this study seeks to. Morningstar regularly reviews the category structure. The contents in this website were prepared in good faith and the Private Pension Administrator Malaysia PPA expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion.

You can make pre-retirement withdrawal for the following purposes without 8 tax penalty4. Address of Private Retirement Scheme- PRS submit your review or ask any question search nearby places on map. The Morningstar Categories for funds in the Malaysia Private Retirement Scheme universe were first established shortly after the establishment of the initiative by the Malaysian Government to help investors make meaningful comparisons between Investment funds.

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. In this regardthe Malaysian Government.

Prs Malaysia 2019 Review Should You Really Invest

How To Choose The Best Private Retirement Scheme Malaysia

Pdf The Awareness Of Private Retirement Scheme And The Retirement Planning Practices Among Private Sector Employees In Malaysia

Deciphering The Top 10 Performing Growth Category Prs Funds I3investor

Prs Malaysia 2019 Review Should You Really Invest

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

3 Reasons Why You Should Invest In Prs Private Retirement Scheme Malaysia Retirement Youtube

Prs Malaysia 2019 Review Should You Really Invest

I Ran The Numbers On All 57 Prs Funds And Found That Only 1 Beats The Asb Returns And 6 Beats The Epf Returns Consistently After Fees Not The Greatest Odds So

Best Private Retirement Schemes Malaysia 2022 Imoney My

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

How To Choose The Best Private Retirement Scheme Malaysia

Prs Malaysia 2019 Review Should You Really Invest

Prs Malaysia 2019 Review Should You Really Invest

Taking Charge Of Your Retirement Is Good For You Prs Live

More Reasons To Grow Your Retirement Savings With Prs

Private Retirement Scheme In Malaysia Dividend Magic